New Jersey Solar Incentives

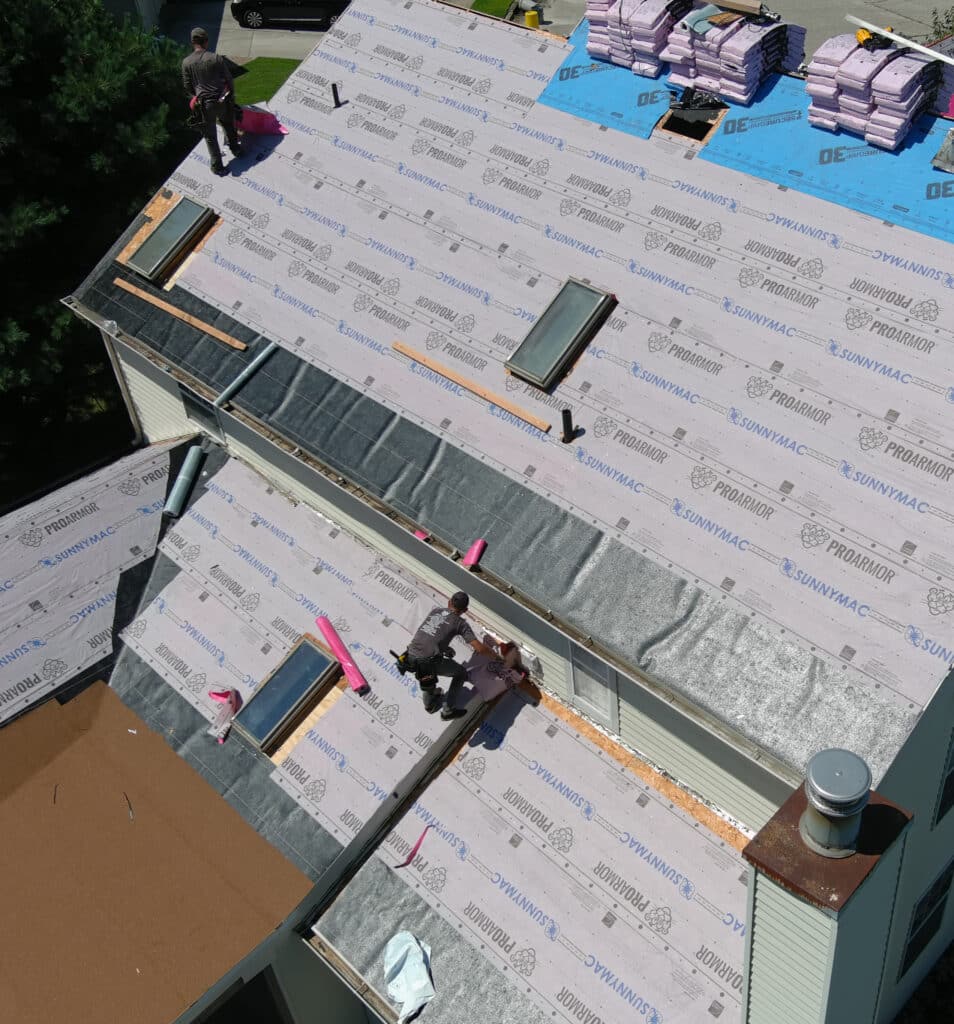

As electricity rates continue to rise, switching to solar has never been more appealing—especially in New Jersey, where generous state and federal incentives are available to make your transition more affordable. At SunnyMac, we help homeowners tap into these powerful programs with end-to-end support, ensuring maximum savings and a smooth experience from consultation to installation.

Federal Solar Tax Credit

Take advantage of the Federal Solar Investment Tax Credit (ITC)—a nationwide benefit that reduces your tax bill by 30% of your total solar installation costs. This substantial credit applies to both the equipment and labor involved in your project, helping make solar more accessible than ever.

To qualify, homeowners must reside in the home (not a landlord) and the solar energy system must be fully purchased, either upfront or through a solar loan (leased systems are not eligible). The Federal solar credit can also be used for the purchase and professional installation of an EV charger or solar battery, both services provided by SunnyMac. Learn more about the Federal Solar Tax Credit.

New Jersey SREC Program

Earn money for clean energy your system produces through the New Jersey SREC (Solar Renewable Energy Certificate) program. This initiative, formally known as the Successor Solar Incentive (SuSI) program, allows you to generate one SREC-II certificate for every megawatt-hour (MWh) of electricity your system produces.

These certificates can then be sold to utility companies that are required to meet state renewable energy targets, putting cash back in your pocket while powering your community.

New Jersey Solar Sales Tax Exemption

All residential solar energy systems in New Jersey are 100% exempt from state sales tax. That’s an immediate 6.625% savings on your total system cost — no paperwork required. This automatic benefit helps reduce your upfront investment, making solar even more affordable from the start.

New Jersey Solar Property Tax Exemption

Worried about increased property taxes? Don’t be. New Jersey protects homeowners with a property tax exemption, meaning the value your solar system adds to your home is not taxed. You enjoy higher home value and long-term energy savings without an increase in your property tax bill.

Net Metering in New Jersey

Net metering allows you to earn credit for excess solar power sent back to the grid. In New Jersey, all major utilities, including PSE&G, JCP&L, Atlantic City Electric, and Rockland Electric participate in the program.

Features:

- No system size limit

- Unlimited annual earnings potential

- Credit applied to future utility bills

With net metering, your home stays connected, your bills shrink, and your energy independence grows stronger every year.

Get started today! Register for a complimentary Solar Savings Analysis today!

Get Your Free Savings Analysis